Where Wealth Managers

create and distribute structured products at an institutional standard

Regulatory and technological infrastructure to build and scale proprietary structured products and bring them to market with institutional-grade governance.

Join those who are already digitizing their operations with Bloxs

Solutions built by market experts, for those who live the market

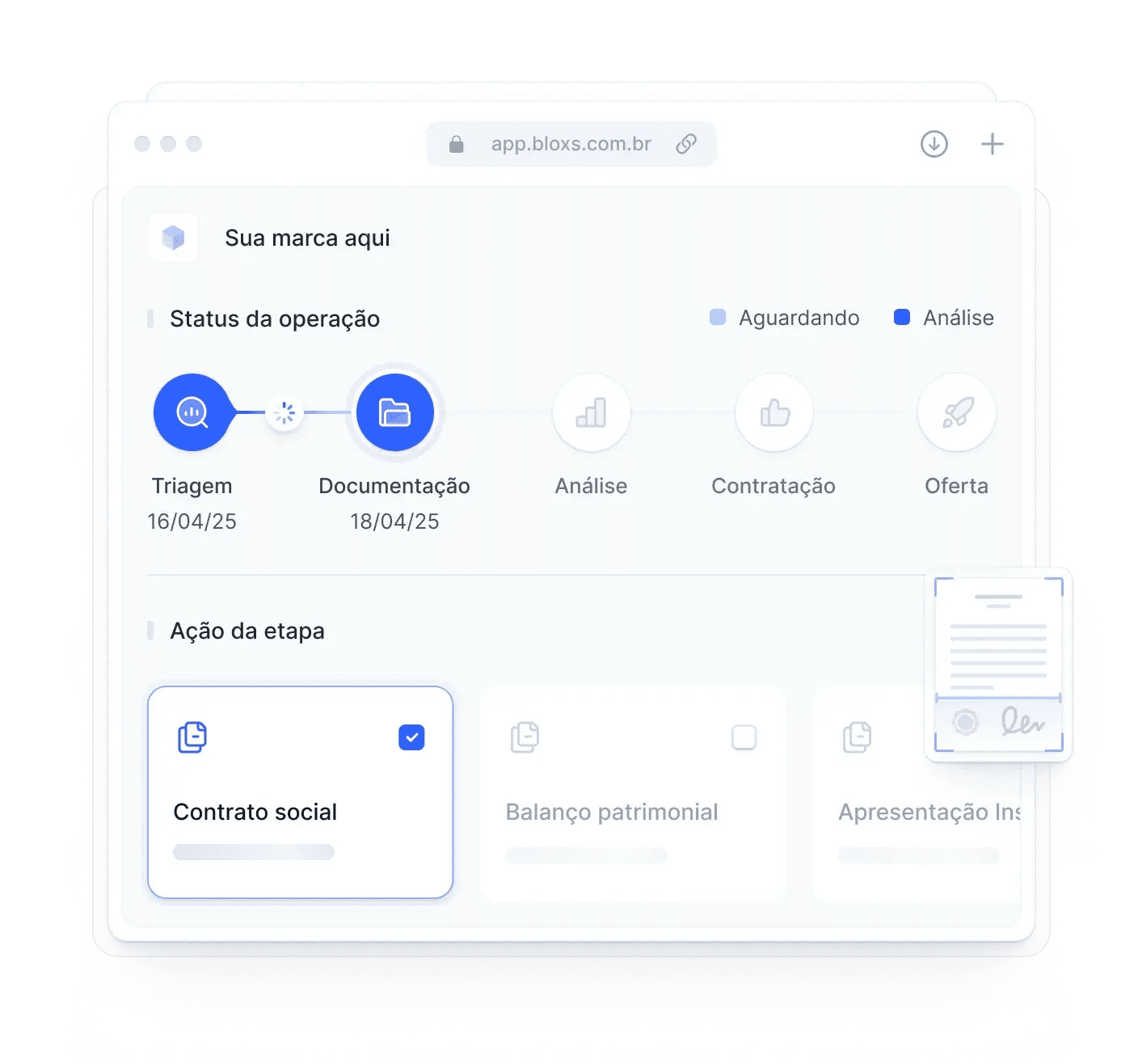

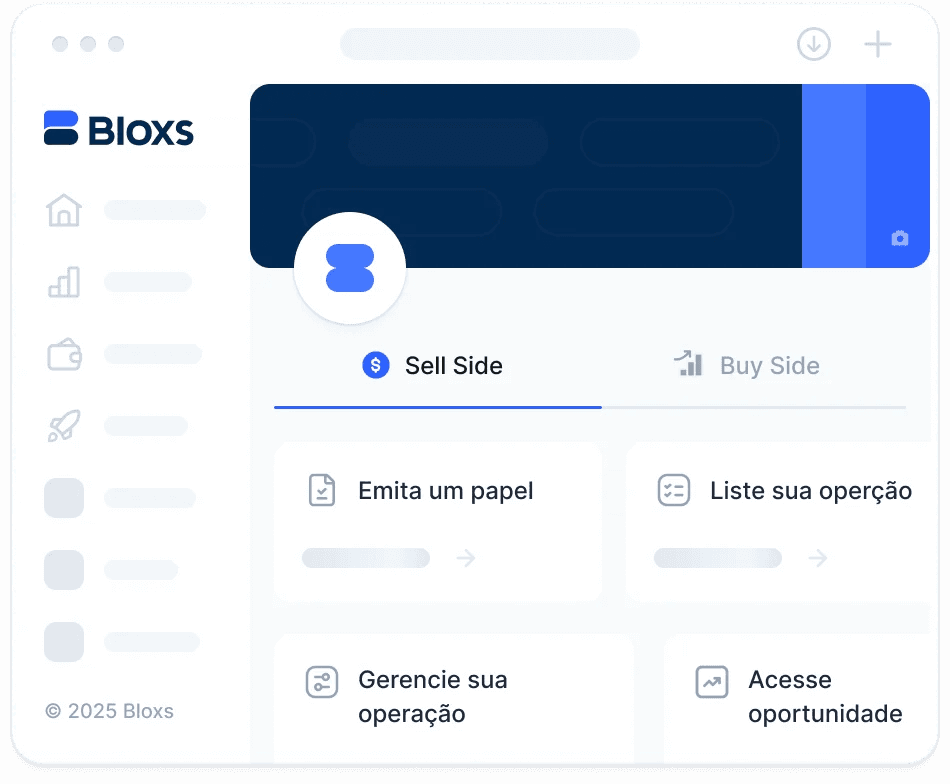

For Issuers

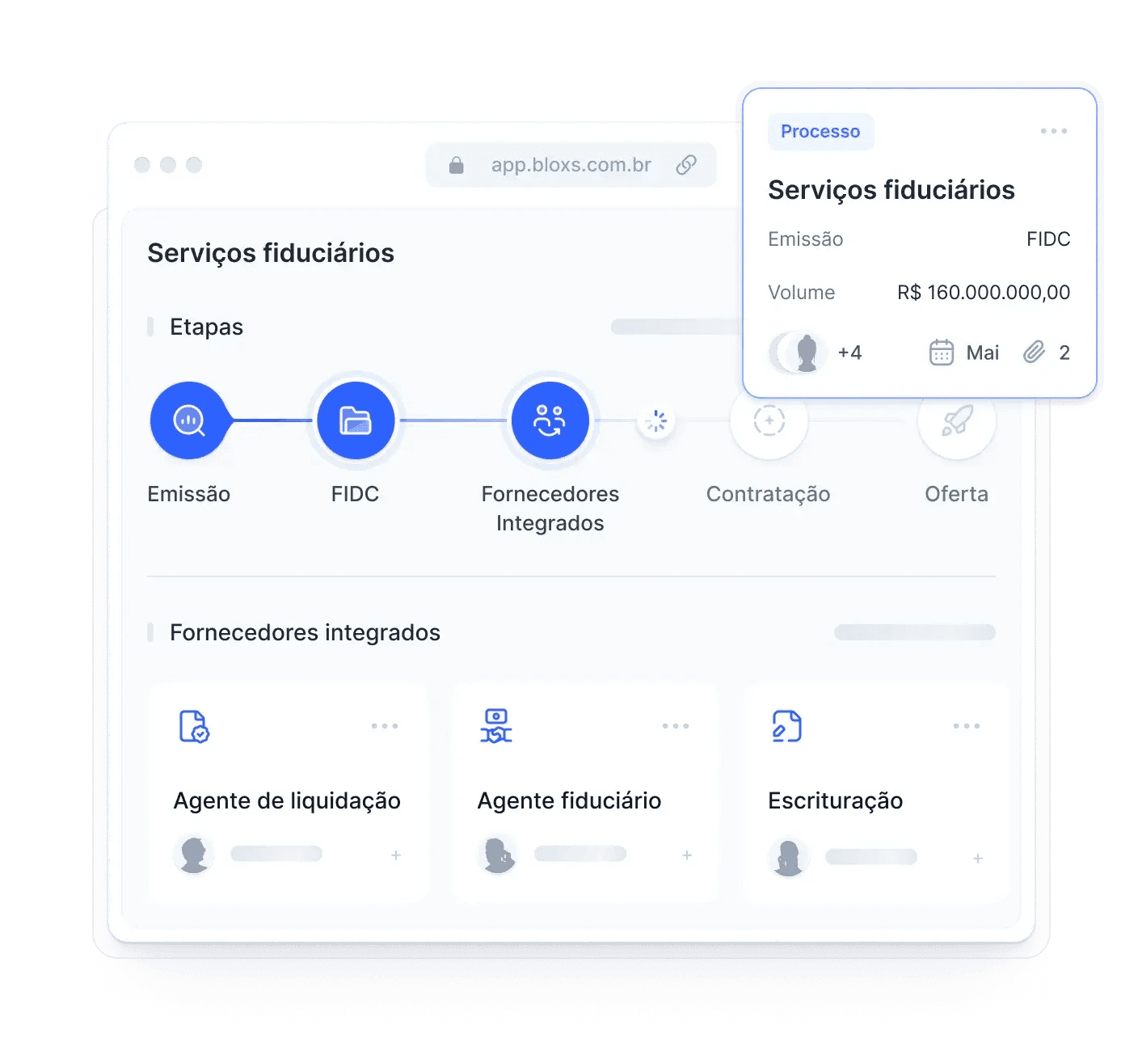

A complete platform to structure, issue, and distribute securities in a regulated environment — integrated and connected to the institutional market.

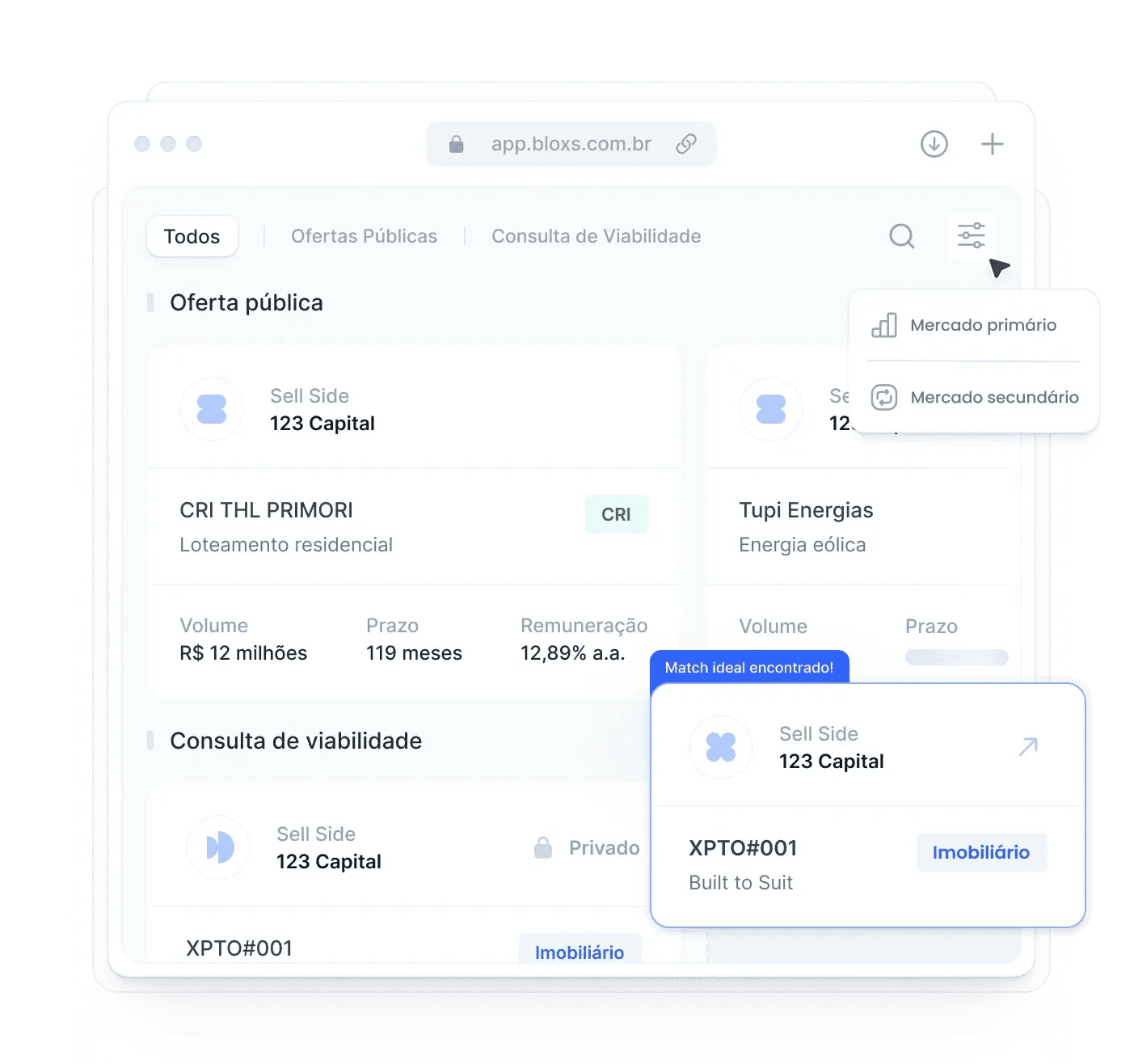

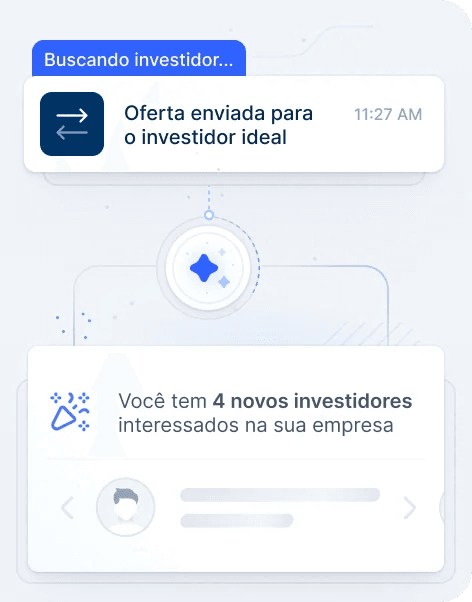

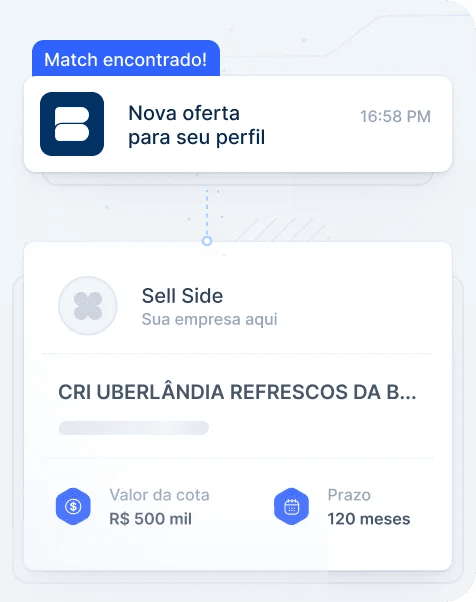

For institutional investors

Find deals that match your profile, engage with issuers, and make decisions backed by security and data intelligence.

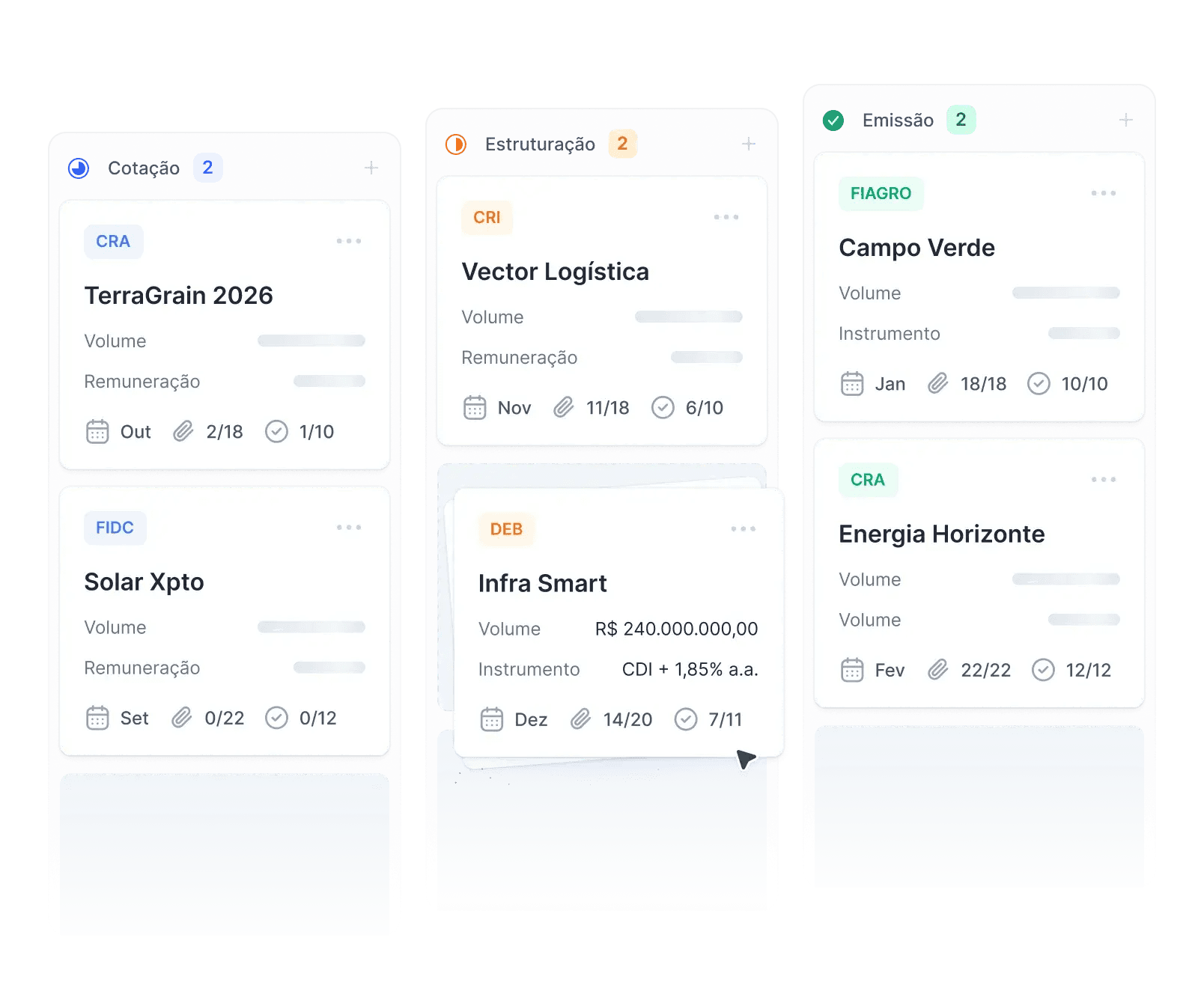

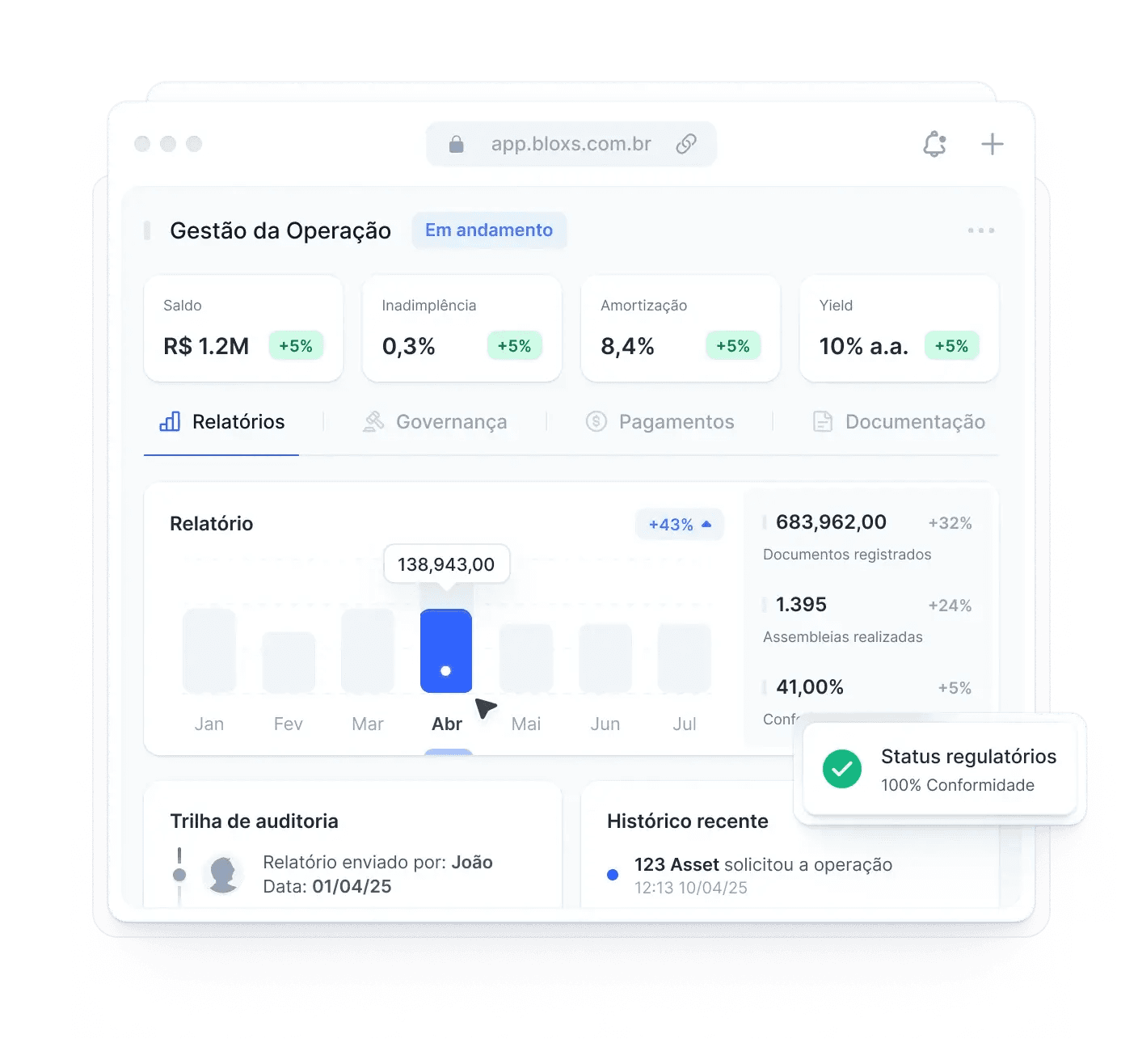

Everything your operation needs from end to end — all in one place

Connect your operation to the future of Capital Markets.

Sign up and experience the platform that is transforming how issuers and investors operate in Brazil.

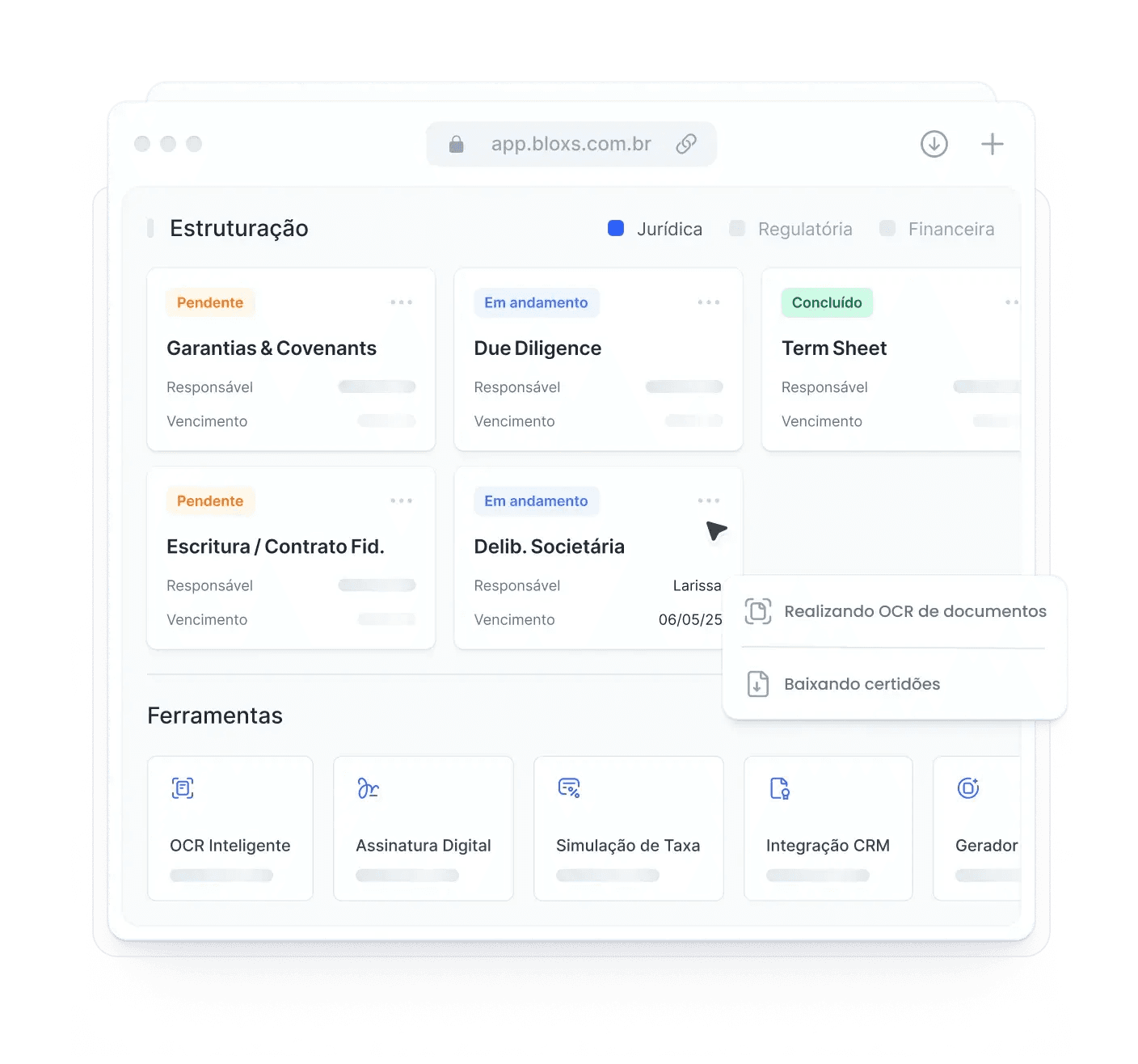

Cutting-edge technology to structure, distribute, and manage assets with intelligence

A complete platform to structure, distribute, and manage assets.

Launch your own origination and distribution platform.

Modular tools to boost your operation in the Capital Markets.

Artificial Intelligence that powers your operations

Leverage intelligent agents to automate workflows, support strategic decisions, and maximize the performance of your operations.

Security, compliance, and trust in every transaction

Regulated infrastructure, data protection, and robust governance to safeguard your operations at every stage.

Trust that turns into real results

Discover real stories from issuers and investors who are already accelerating their operations with Bloxs.

Transform the way you operate in the Capital Markets

Be part of the ecosystem that digitizes, connects, and accelerates issuers and institutional investors through cutting-edge technology.